See the Pay Stations general help for more information.

The PayStation processing keeps a complete audit trail of all activity carried out on the paystation. The audit trail is maintained on the server and can be accessed from the main online to provide audit logs and information to help resolve any problems arising.

When the paystation is started up, library staff must run it up by logging in using a regular Vubis Smart login and password. This identifies the PayStation to the system, just as a regular login identifies the user. We would expect a specific login to be defined to the system for pay stations (.eg. PS1 or some such identifier), but technically this is NOT necessary.

To all intents and purposes therefore, transactions recorded on the system are therefore identified as if they had been carried out online by that user.

An audit trail will be kept of all actions carried out on the PayStation, not just successful payments. This audit trail may be accessed from AFO491 – for the current logged in user. In order to see an audit trail for PS1, say, the staff member must therefore log in to VubisSmart as “PS1”.

The Audit trail may be printed using the standard Print functions on the system (see any such “grid” processing in Vubis Smart) or may be printed by a special print command, which will allow a summary to be printed (along the lines shown) or a FULL listing for the given day (to include every event logged, down to the individual coins).

After choosing this option an overview screen will be displayed.

Only a summary of each transaction is displayed. A “running total” is shown which should correspond to the amount of cash in the kiosk.

: Selecting a specific line gives further details of the transaction – this depends on the specific line selected.

: On entry to the function the system shows a summary of what has happened on the paystation for “today”. Another date may be chosen by clicking on this button.

Note

Since the kiosk does not pay change, it is possible for the user to overpay. This extra cash is shown in the “current running total” display.

For a staff login there is nothing further of interest to display, but here are the two cases :

Borrower transaction: The system displays the individual coins entered; if there were any mistypes of PIN and so on.

For a Running total or Empty cash box, the following is shown: The system displays the individual coin amounts received and summarises the number of each type of coin, allowing a reconciliation to be made between what was recorded and what is actually in the cash box.

It is possible for the library to configure the system to generate reports on income in the way that the library wishes. It is the library's responsibility to configure and maintain these settings appropriately for them via AFO 494 and AFO 497.

If so, then reporting will be available via this option of AFO 491. After selecting this option a sub menu will be displayed:

The various options are described in the next sections.

This report is based on VAT indicators, as defined in AFO 497 – Financial groups –Financial group management.

After selecting this option, an input form will be displayed:

Receiving location: A dropdown list from which * (All) locations may be selected, or a specific location. The dropdown list will show the (All) option first, followed by the current location and then other locations for the financial group for the current location only.

Date range: An option to use today's date only or the range of dates specified in the Start date and End date fields.

Payment method: You can move one or more specific methods to the right for reporting on those method(s) only. If no method is selected, the report will cover all payment methods in use. Possible payment methods are defined by the library in AFO 494 (Define cash codes) plus the "predefined" methods (Cash, Bank, Account, Giro, Credit/debit card).

Sort order: The preferred sort order for the report. The three possibilities are shown and the order may be defined by entering 1, 2, 3 against each setting. (If a specific date, specific location, specific payment method is selected, then of course the option for that field is irrelevant).

If NO sort order is defined for a specific field, then the totals will be aggregated for that selection. For example, if ALL payment types are selected, then leaving the Sort order/Payment method blank will cause the system to total all the payments; if defined, then the system will enumerate the totals for each type of payment method.

If more than one selection field has an "All" setting, then a sort order MUST be defined.

Report title: A report title which may be changed. The default is "Payment summary by VAT indicator".

Lines per page: Number of lines per page, default 50; for textual output.

After entering the required data, you can click . The system will switch to the standard screen for generating output.

This report summarises the payments made, according to the selection, grouping them by the charge group code, as defined in AFO 497 – Financial groups – Charge groups.

After selecting this option, an input form will be displayed:

Account credited: In this case, this is the location to which the money notionally belongs. The dropdown list will show the (All) option first, followed by the current location and then other locations for the financial group for the current location only.

Date range: An option to use today's date only or the range of dates specified in the Start date and End date fields.

Payment method: You can move one or more specific methods to the right for reporting on those method(s) only. If no method is selected, the report will cover all payment methods in use. Possible payment methods are defined by the library in AFO 494 (Define cash codes) plus the "predefined" methods (Cash, Bank, Account, Giro, Credit/debit card).

Charge type: allows a selection of a set of types of charges. Valid options are:

· Sales the report will include "sales items" only

· Miscellaneous the report will include miscellaneous payments (via AFO 417) only

· Invoiced the report will include only miscellaneous payments for which an invoice/reference number was entered in AFO 417

· General All the other types of charges

· All All charges

Report title: A report title which may be changed. The default is "Income summary by group".

Lines per page: Number of lines per page, default 50; for textual output.

After entering the required data, you can click . The system will switch to the standard screen for generating output.

This report allows for the detailed reporting of the payments against charges individually.

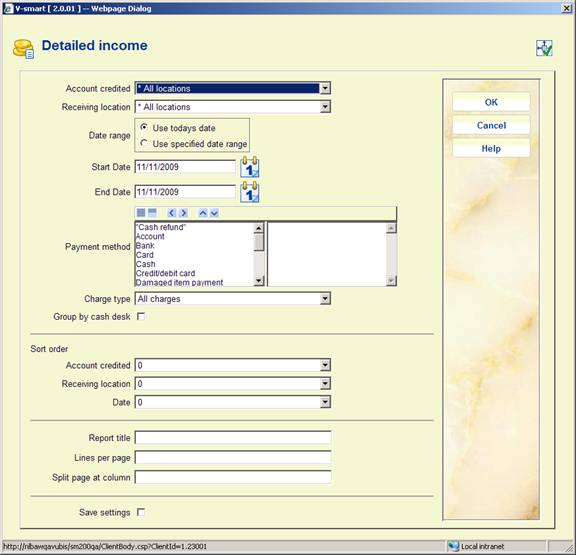

After selecting this option, an input form will be displayed:

Account credited: In this case, this is location to which the money notionally belongs. The drop down list will show the (All) option first, followed by the current location and then other locations for the financial group for the current location only.

Receiving location: A drop down list from which * (All) locations may be selected, or a specific location. The drop down list will show the (All) option first, followed by the current location and then other locations for the financial group for the current location only.

Date range: An option to use today's date only or the range of dates specified in the Start date and End date fields.

Payment method: You can move one or more specific methods to the right for reporting on those method(s) only. If no method is selected, the report will cover all payment methods in use. Possible payment methods are defined by the library in AFO 494 (Define cash codes) plus the "predefined" methods (Cash, Bank, Account, Giro, Credit/debit card).

Charge type: allows a selection of a set of types of charges. Valid options are:

· Sales the report will include "sales items" only

· Miscellaneous the report will include miscellaneous payments (via AFO 417) only

· Invoiced the report will include only miscellaneous payments for which an invoice/reference number was entered in AFO 417

· General All the other types of charges

· All All charges

Group by cash desk: The report allows the specific device used to accept payment to be reported, OR, if the cash desks are defined and used, then the cash desk is displayed. If this option is checked, the cash desk rather than the device is displayed. For output to a spreadsheet then both settings are always reported.

It should be noted that BOTH Account credited AND Receiving location can be specified individually or as "All". This means that this report can be used to detail all the individual payments received at a given location, or detail all the income due to a given location.

Sort order: The preferred sort order for the report. The three possibilities are shown and the order may be defined by entering 1, 2, 3 against each setting. (If a specific date, specific location, specific payment method is selected, then of course the option for that field is irrelevant).

If NO sort order is defined for a specific field, then the totals will be aggregated for that selection. For example, if ALL payment types is selected, then leaving the Sort order/Payment method blank will cause the system to total all the payments; if defined, then the system will enumerate the totals for each type of payment method.

If more than one selection field has an "All" setting, then a sort order MUST be defined.

Report title: A report title which may be changed. The default is "Income summary by group".

Lines per page: Number of lines per page, default 50; for textual output.

Split page at column: The width of the output for printed output is unlikely to fit on a regular page. The system will optionally print two pages per line of output (pages 1a, 1b) – this is similar to the way that spreadsheets typically print (columns 1-n on printed sheet 1, then n-m on printed sheet 2 and so on). Since this depends on the way that the user will print the information (e.g. landscape or portrait), what the default font size is etc- then which column to split at is a runtime option.

After entering the required data, you can click . The system will switch to the standard screen for generating output.

· Document control - Change History

|

Version |

Date |

Change description |

Author |

|

1.0 |

June 2008 |

creation |

|

|

2.0 |

November 2009 |

minor upates; new option income management reports |

|